OPEN-SOURCE SCRIPT

Kal’s MTF ADX Rangoli Roller

Kaly MTF ADX Rangoli Roller is a method/study for finding trending stocks, indexes and cryptocurrencies using two different data periods (10, 5) of ADX Overlap over different time-frames (10m, 1H, 4H, 1D, 1W, 1M). In the study, I used 5-Period ADX for all mentioned time-frames. You may use 10-Period ADX for lower time-frames especially 10m and 1H.

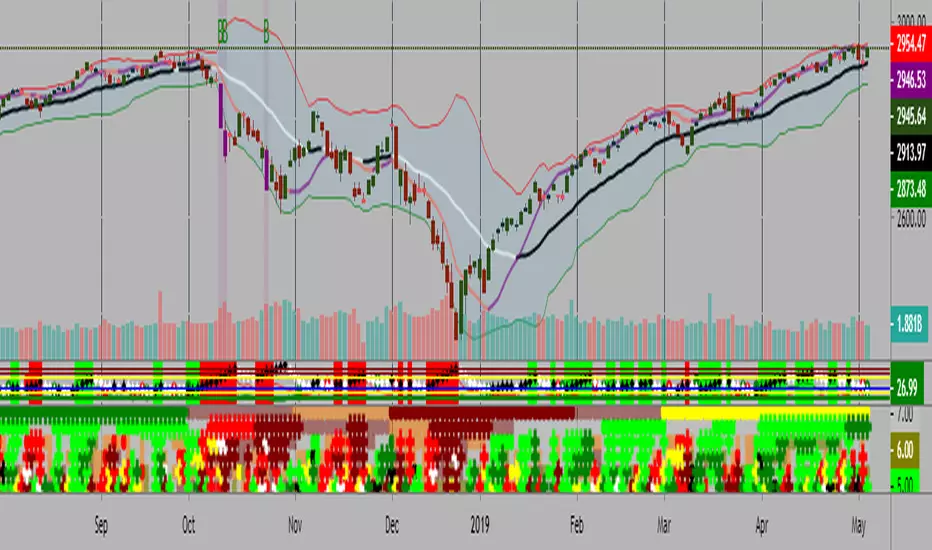

Sample Image of the pinescript code(at the end of this post) in Tradingview looks as follows:

Note: Kal's MTF ADX Rangoli Roller is the lower Plot. The upper plot is KAL’s ADX Overlap Technical Study with MACD Filter(https://www.tradingview.com/script/pB9EZPQY-ADX-Overlap-with-MACD-Filter/)

Description:

----------------

In the study plot, the lowest row is 10m, row above is 1H, row above is 4H, then 1D, then 1W and highest row is 1M

Black is CRSI Overbought condition for that time-frame. It’s best to wait and research for possibility of trend reversal because

White is CRSI Oversold condition for that time-frame. It’s best to wait and research for possibility of trend reversal because

I am a disabled man. Therefore, I am not able to write in detail here today. More Details will follow as time permits. Please let me know if I am missing anything…

Legal Disclaimer: I published here so I get replies from fellow viewers to educate myself and for my daily expenses. Hence, if anyone uses this script for making their decisions, I am not responsible for any failures incurred.

Safe Trading!

Kal Gandikota

PS: If you found this script interesting and edifying please follow and upvote.

PS2: Please kindly donate for my daily expenses (atleast as you would on streets) at the following addresses:

PS3: For more information on ADX and CRSI, please 'Google' or search here yourself.

PS4: This study is intended for research in creating automated Python Trading Systems using Pandas(https://steemit.com/python/@chipmaker/how-to-find-guidance-on-building-python-based-cryptocurrency-trading-bots).

Screenshots of the pinescript code looks as follows:

10minute Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Hour Screenshot of Kal's MTF ADX Rangoli Roller (Above)

4 Hour Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Day Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Week Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Month Screenshot of Kal's MTF ADX Rangoli Roller (Above)

Sample Image of the pinescript code(at the end of this post) in Tradingview looks as follows:

Note: Kal's MTF ADX Rangoli Roller is the lower Plot. The upper plot is KAL’s ADX Overlap Technical Study with MACD Filter(https://www.tradingview.com/script/pB9EZPQY-ADX-Overlap-with-MACD-Filter/)

Description:

----------------

In the study plot, the lowest row is 10m, row above is 1H, row above is 4H, then 1D, then 1W and highest row is 1M

- Lime(Bright Green) dot implies Trending Uptrend for that time-frame (first phase)

- Green dot implies Trending Uptrend for that time-frame (second phase near exhaustion)

- Red dot implies Trending Downward for that time-frame (first phase)

- Maroon dot implies Trending Downward for that time-frame (second phase near exhaustion)

- Lime cross implies Strong Trending Uptrend for that time-frame (first phase)

- Green cross implies Strong Trending Uptrend for that time-frame (second phase near exhaustion)

- Red cross implies Trending Strong Downward for that time-frame (first phase)

- Maroon cross implies Trending Strong Downward for that time-frame (second phase near exhaustion)

- Yellow is ‘Squeeze On’ setting. During the squeeze period, the ADX signals are almost always ineffective. One may wait and watch over during this time. Once the Squeeze is released (i.e. no longer yellow), the trend corresponds to the color of the dots and crosses.

Black is CRSI Overbought condition for that time-frame. It’s best to wait and research for possibility of trend reversal because

- 1. Profit-booking/trimming happens after CRSI Overbought condition.

- 2. Large Short-sellers may take huge positions during this time pushing the stock prices up.

White is CRSI Oversold condition for that time-frame. It’s best to wait and research for possibility of trend reversal because

- 1. Profit-booking/trimming happens after CRSI Oversold conditions.

- 2. Large buyers may take huge positions during this time pushing the stock prices down.

I am a disabled man. Therefore, I am not able to write in detail here today. More Details will follow as time permits. Please let me know if I am missing anything…

Legal Disclaimer: I published here so I get replies from fellow viewers to educate myself and for my daily expenses. Hence, if anyone uses this script for making their decisions, I am not responsible for any failures incurred.

Safe Trading!

Kal Gandikota

PS: If you found this script interesting and edifying please follow and upvote.

PS2: Please kindly donate for my daily expenses (atleast as you would on streets) at the following addresses:

- BTC Wallet: 1NeDC1GvpFa49DFLuT1v28ohFjqtoWXNQ5

- ETH Wallet: 0x35e557F39A998e7d35dD27c6720C3553e1c65053

- NEO Wallet: AUdiNJDW7boeUyYYNhX86p2T8eWwuELSGr

PS3: For more information on ADX and CRSI, please 'Google' or search here yourself.

PS4: This study is intended for research in creating automated Python Trading Systems using Pandas(https://steemit.com/python/@chipmaker/how-to-find-guidance-on-building-python-based-cryptocurrency-trading-bots).

Screenshots of the pinescript code looks as follows:

10minute Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Hour Screenshot of Kal's MTF ADX Rangoli Roller (Above)

4 Hour Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Day Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Week Screenshot of Kal's MTF ADX Rangoli Roller (Above)

1 Month Screenshot of Kal's MTF ADX Rangoli Roller (Above)

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Signature:Pls kindly donate for my daily expenses(atleast as you would on streets) at the following BTC Wallet address:

1HZBnoSoLo9ptuRdMMy29q9LLVZFMzaugd

1HZBnoSoLo9ptuRdMMy29q9LLVZFMzaugd

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Signature:Pls kindly donate for my daily expenses(atleast as you would on streets) at the following BTC Wallet address:

1HZBnoSoLo9ptuRdMMy29q9LLVZFMzaugd

1HZBnoSoLo9ptuRdMMy29q9LLVZFMzaugd

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.