Comparaison de force relative

Indicateurs, stratégies et bibliothèques

This indicatore plot for every candle a % difference referred to the corresponding BTCUSDT candle, so you can know if the chart is performing better or worse than Bitcoin. Simple as that. Enjoy.

Comparaison de force relative

Overview: The EMA-Based Relative Strength Labels indicator provides a dynamic method to visualize the strength of price movements relative to an Exponential Moving Average (EMA). By comparing the current price to the EMA, it assigns labels (A, B, C for bullish and X, Y, Z for bearish) to candles, indicating the intensity of bullish or bearish behavior. Key...

This script evaluates the relative strength of the current symbol with respect to your chosen symbol. At the same time it gives an idea about the trend of the reference symbol. Under default settings, it evaluates the strength with respect to NIFTY50. While the value of the bars represents the relative strength, Colors of the bars indicate the relative strength...

This Pine script indicator is designed to create a visual representation of the percent rank for multiple financial instruments. Here's a breakdown of its key features: Percent Rank Calculation: The core functionality of this Pine script indicator revolves around the calculation of the percent rank for each selected financial instrument. The percent rank is...

The Relative Strength Orbital Graph indicator is a tool that shows the historical performance of various user-selected securities against a selected benchmark. 🔶 USAGE This tool depicts a simple scatter plot using the RS-Ratio as the X-axis and RS-Momentum as the Y-axis of the user-selected symbols against the selected benchmark. The graph is divided into...

Rate of Change Machine Author: RWCS_LTD Disclaimer: This script is provided for informational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor before making any investment...

Multi Period Relative Strength Indicator This indicator is meticulously designed around the fundamental concept of relative strength, providing a powerful tool to assess an instrument's performance against peers or a benchmark index within the same asset class. Tailored for short-term swing trend analysis, it equips traders with the insights needed to make...

Comparative Relative Strength (CRS) is a relative momentum indicator, used to compare a security against an index, or against another security. The comparison is used to show the relative performance to each other. This script is a Quality of Life improvement, which attempts to match the base symbol to its relevant index on the local stock exchange. Thus...

This script provides a quick overview of the relative strength and correlation of the symbols in a sector by showing a line chart of the close prices on a percent scale with all symbols starting at zero at the left side of the chart. It allows a great deal of flexibility in the configuration of the sectors and symbols in it. The standard preset sectors cover the...

RedK Relative Strength Ribbon (RedK RS_Ribbon) is TA tool that plots the Relative Strength of the current chart symbol against another symbol, or an index of choice. It enables us to see when a stock is gaining strength (or weakness) relative to (an index that represents) the market, and when it hits new highs or lows of that relative strength, which may lead to...

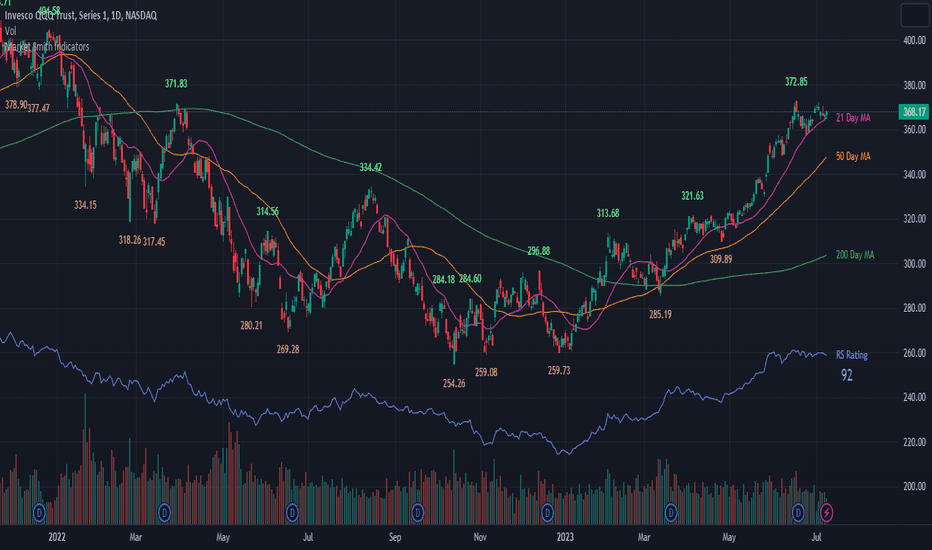

Market Smith has a collection of tools that are useful for identifying stocks. On their charts they have a 21/50/200 day moving averages, high and low pivot points, a relative strength line, and a relative strength rating. This script contains indicators for the following: 21/50/200 Day Moving Averages High and Low pivot points A Relative Strength line A...

Welcome to the NDR 63-Day QQQ-QQEW ROC% Spread script! This script is a powerful tool that calculates and visualizes the 63-day Rate of Change (ROC%) spread between the QQQ and QQEW tickers. This script is based on the research conducted by Ned Davis Research (NDR), a renowned name in the field of investment strategy. ⚙️ Key Features: 👉Rate of Change...

This is an Indicator which identifies different Trading Zones on the chart. This should be Primarily used for Long Trades. Trading Zones: and the Reasoning behind them Long Zone -> One can do a Potential Entry (Buy) when this Zone is identified, but one could also wait for 'Entry Zone' (explained next) for a better Risk/Reward Trade. Long Zones are...

🖖 Hi all! Check out my NOMMO AUTOMATE indicator for trend detection, trend change points, hedging opposite trend impulses. What the script do: ☑️ Detecting local and global trends and trend change points, detecting opposite to current trend impulses. How the script do it: ☑️ The indicator compares RSI indicators on chosen by user Trend TF1 and Trend TF2 and...

Introducing the Market Relative Candle Ratio Comparator, a visually captivating script that eases the way you compare two financial assets, such as cryptocurrencies and market indices. Leveraging a distinctive calculation method based on percentage changes and their averages, this tool presents a crystal-clear view of how your chosen assets perform in relation to...

Returns a (top 10 by default) coins matrix correlation between various user-selected symbols Correlation matrices can be useful to see the linear relationship between various symbols, this is an important tool for analyze market. Alert with matrix. You can send it to the sheets

Asset Selection Indicator This is a table what will help you to see what asset's are optimal to use in your portfolio or strategies. By different metrics what are ploted on a table you will see how each individual asset performe compare to other Sharpe, sortino, omega ratio's are very valueble metriscs in bulding portfolio and now you can easly see them without...

The original idea from this script is from the script " Percentage Relative Strength " by dman103 . The original script compared a symbol to an index by their everyday percentage change. The symbol percentage was subtracted from percentage change of the index, & the results were then smoothed by moving averages. Instead of daily percentage changes, this script...

![Relative Strength Orbital Graph [LuxAlgo] AMD: Relative Strength Orbital Graph [LuxAlgo]](https://s3.tradingview.com/x/XZPlAujd_mid.png)

![[TTI] NDR 63-Day QQQ-QQEW ROC% Spread QQQ: [TTI] NDR 63-Day QQQ-QQEW ROC% Spread](https://s3.tradingview.com/7/7rUEaj32_mid.png)

![Asset Selection Indicator by [VanHelsing] BTCUSD: Asset Selection Indicator by [VanHelsing]](https://s3.tradingview.com/p/pJKXIy8J_mid.png)