Bitcoin Analysis – November 22 | Ready to Build Structure? 🧩📉

Hello to all traders out there! Hope you’re having a great day wherever you are.

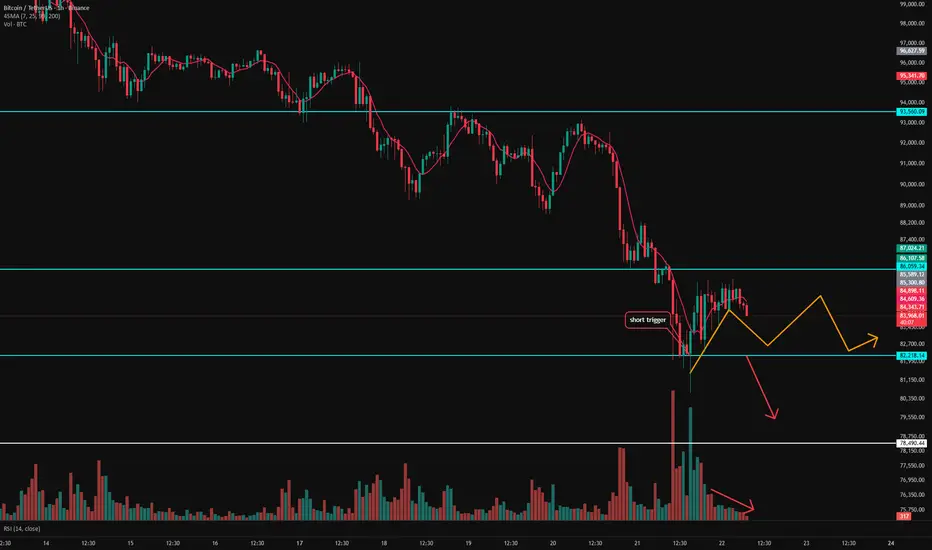

As you can see, price refused to drop below the $82K level and is currently in a resting phase.

Also worth noting:

📉 Fear & Greed Index is at 11 — extreme fear.

Now let’s break down the possible scenarios for today:

🟦 Scenario A – Likely Range & Structure Building

One of the most probable scenarios today is a range, something we usually see on Saturdays.

Here’s why:

Price already gave a solid reaction to the $82K level

But volume keeps dropping — naturally, because it’s Saturday

Many traders are waiting for the market to build structure so they can take proper triggers

A ranging market today makes sense, and it can actually be a great time to:

Review your trade journal

Scan for strong potential coins for the upcoming week

⏰ Tip: I recommend checking the chart every 4 hours — especially before the 4H candle closes and during the US session.

🟥 Scenario B – Breakdown & Short Opportunity

Another strong scenario: a drop below $82,200.

This level is a valid short trigger only if broken, but ideally, I want to see one more retest first.

Why?

The market reacted too aggressively to this level earlier — meaning it might not be a “clean” level yet.

A second reaction would confirm it more reliably.

If $82.2K gets retested on the 1H timeframe, I’ll likely take a short with a tight stop.

🟩 Scenario C – Pump Above $86K? Still Not Longing

If price pushes above $86K, I’m still not opening longs.

I want to see buyer strength first.

If buyers lose momentum after the move up, then the first lower high / lower low, or even equal structure on the 1H timeframe, gives me a clean short setup.

In a bearish environment, every new high is a shorting opportunity.

🔚 Final Thoughts

These are today’s scenarios.

And remember:

💡 Risk management, position sizing, and reward-to-risk matter far more than any chart you see online.

Your goal is simple: stay alive long enough to become profitable.

Wishing you all a profitable day!

If you have any thoughts, feel free to share them in the comments. 📩

Hello to all traders out there! Hope you’re having a great day wherever you are.

As you can see, price refused to drop below the $82K level and is currently in a resting phase.

Also worth noting:

📉 Fear & Greed Index is at 11 — extreme fear.

Now let’s break down the possible scenarios for today:

🟦 Scenario A – Likely Range & Structure Building

One of the most probable scenarios today is a range, something we usually see on Saturdays.

Here’s why:

Price already gave a solid reaction to the $82K level

But volume keeps dropping — naturally, because it’s Saturday

Many traders are waiting for the market to build structure so they can take proper triggers

A ranging market today makes sense, and it can actually be a great time to:

Review your trade journal

Scan for strong potential coins for the upcoming week

⏰ Tip: I recommend checking the chart every 4 hours — especially before the 4H candle closes and during the US session.

🟥 Scenario B – Breakdown & Short Opportunity

Another strong scenario: a drop below $82,200.

This level is a valid short trigger only if broken, but ideally, I want to see one more retest first.

Why?

The market reacted too aggressively to this level earlier — meaning it might not be a “clean” level yet.

A second reaction would confirm it more reliably.

If $82.2K gets retested on the 1H timeframe, I’ll likely take a short with a tight stop.

🟩 Scenario C – Pump Above $86K? Still Not Longing

If price pushes above $86K, I’m still not opening longs.

I want to see buyer strength first.

If buyers lose momentum after the move up, then the first lower high / lower low, or even equal structure on the 1H timeframe, gives me a clean short setup.

In a bearish environment, every new high is a shorting opportunity.

🔚 Final Thoughts

These are today’s scenarios.

And remember:

💡 Risk management, position sizing, and reward-to-risk matter far more than any chart you see online.

Your goal is simple: stay alive long enough to become profitable.

Wishing you all a profitable day!

If you have any thoughts, feel free to share them in the comments. 📩

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.