The Setup: A Pullback with a Plan

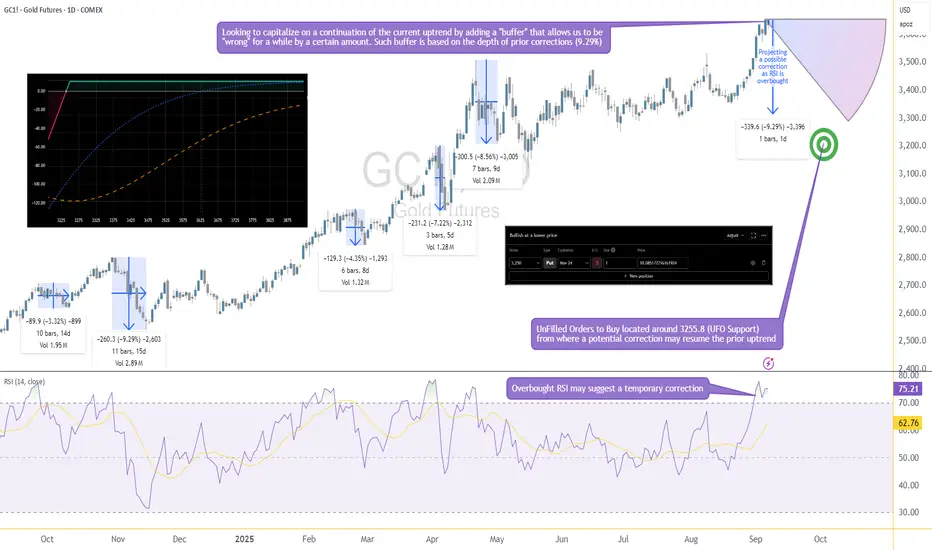

Gold has been riding a strong bullish wave, yet momentum indicators suggest it's time for a breather. RSI is now overbought, and if history repeats, we could see a healthy correction of up to 9.29%, in line with prior pullbacks. This projects price near 3255, where we also find a cluster of UnFilled Orders (UFOs) acting as a potentially relevant support. It’s a key price area where buyers may step in again.

Rather than try to perfectly time the correction or the bottom, we’re applying a more forgiving approach: selling a PUT far below current price—generating income while leaving room to be wrong by over 375 points.

This is not a hedge. This is a standalone income strategy that accepts risk but frames it intelligently using technical context and options structure.

The Strategy: Selling the 3250 PUT on GC

We're using a simple but powerful strategy—selling a naked PUT—which can generate income or result in ownership of Gold at a deep discount if price dips.

There are two possible outcomes here:

The position benefits from time decay and stable to rising prices, but it does carry the full downside exposure of long Gold futures if the trade moves against us.

We want to be very clear here—this is a naked trade with undefined risk. That doesn’t make it reckless if done with sizing discipline and technical alignment, but it’s not a beginner-friendly strategy.

Gold Contract Specs

Understanding the size and risk of what you're trading is critical—especially with naked options.

✅ GC – Gold Futures (Full Size)

✅ MGC – Micro Gold Futures

Why does this matter?

Because if GC collapses below 3250 and you're assigned long, you’ll be exposed to full-size futures. That’s $100 per point of movement. A 50-point drop? That's $5,000 in unrealized loss.

That’s where MGC becomes your best ally. Micro Gold futures offer a scalable way to hedge. If price begins moving down or breaks below the support zone, one could short MGC against the Short GC 3250 PUT to cap further losses or rebalance directional exposure with reduced size and margin impact.

The Technical Confluence: Where Structure Meets Strategy

The 3250 strike isn’t just a random number—it’s calculated. Historical RSI-based corrections in Gold have shown recent worse-case scenarios around 9.29%, and projecting that from recent highs lands us precisely near the 3255 zone. This level also aligns with a clear UFO support, where institutional buyers have likely left behind unfilled orders.

That confluence—statistical retracement, technical indicator, and order flow support—gives the 3250 strike an interesting probability structure. Selling a Put beneath it means we are placing our bet below the “floor” and getting paid while we wait.

If Gold never corrects that far, we profit.

If it does, we might get long near a historically meaningful level.

There’s no need to catch the top. There’s no need to nail the bottom.

Just structure the trade where the odds are already potentially skewed in your favor.

Trade Plan: Reward, Risk & Realism

This trade isn’t about precision entry or leveraged glory—it’s about risk-defined logic with a cash-flow twist. Here's the full breakdown:

🧠 Trade Parameters

🟩 If Gold Stays Above 3250

🟥 If Gold Falls Below 3250

⚠️ Reward-to-Risk?

This isn’t a “set-and-forget” income play—it’s a calculated entry into a structured exposure with a fallback plan.

Risk Management: No Margin for Error

Selling naked options isn’t “free money.” It’s responsibility wrapped in premium. Here's what must be considered:

❗ Undefined Risk

When you sell a naked PUT, you're exposed to the full downside. If Gold drops $100 below your strike, that’s a $10,000 loss. Don’t sell naked options unless you’re ready—and capitalized—to buy the underlying or actively hedge it.

🔄 Use MGC to Hedge

If Gold breaks below 3250, using Micro Gold Futures (MGC) offers a surgical way to hedge risk without overleveraging. A simple short MGC can offset GC losses proportionally, depending on how aggressive the move becomes.

🧮 Precision Matters

📊 Discipline Trumps Direction

This strategy is valid only if risk is respected. The market doesn’t owe anyone consistency—but a structured, risk-controlled approach keeps you in the game long enough to see it.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Gold has been riding a strong bullish wave, yet momentum indicators suggest it's time for a breather. RSI is now overbought, and if history repeats, we could see a healthy correction of up to 9.29%, in line with prior pullbacks. This projects price near 3255, where we also find a cluster of UnFilled Orders (UFOs) acting as a potentially relevant support. It’s a key price area where buyers may step in again.

Rather than try to perfectly time the correction or the bottom, we’re applying a more forgiving approach: selling a PUT far below current price—generating income while leaving room to be wrong by over 375 points.

This is not a hedge. This is a standalone income strategy that accepts risk but frames it intelligently using technical context and options structure.

The Strategy: Selling the 3250 PUT on GC

We're using a simple but powerful strategy—selling a naked PUT—which can generate income or result in ownership of Gold at a deep discount if price dips.

- Underlying Asset: GCZ2025 – using Gold Futures Options (Nov 24 2025 Expiration)

- Strategy: Sell 1x 3250 PUT

- Premium Collected: 10.09 points ≈ $1,009

- Breakeven Price: 3240

- Max Profit: $1,009 (if Gold stays above 3250 until expiration)

- Max Risk: Unlimited below breakeven

There are two possible outcomes here:

- Gold stays above 3250 → we keep the full premium.

- Gold drops below 3250 → we get assigned and become long GC at 3250. From there, we’re exposed to downside risk in Gold, with a breakeven at 3240.

The position benefits from time decay and stable to rising prices, but it does carry the full downside exposure of long Gold futures if the trade moves against us.

We want to be very clear here—this is a naked trade with undefined risk. That doesn’t make it reckless if done with sizing discipline and technical alignment, but it’s not a beginner-friendly strategy.

Gold Contract Specs

Understanding the size and risk of what you're trading is critical—especially with naked options.

✅ GC – Gold Futures (Full Size)

- Symbol: GC

- Contract Size: 100 troy ounces

- Tick Size: 0.10 = $10

- Point Value: 1 point = $100

- Initial Margin (as of Sep 2025): ~$15,000 per contract (subject to change)

- Underlying for the Option: GC Futures

✅ MGC – Micro Gold Futures

- Symbol: MGC

- Contract Size: 10 troy ounces

- Tick Size: 0.10 = $1

- Point Value: 1 point = $10

- Initial Margin: ~$1,500 per contract (subject to change)

Why does this matter?

Because if GC collapses below 3250 and you're assigned long, you’ll be exposed to full-size futures. That’s $100 per point of movement. A 50-point drop? That's $5,000 in unrealized loss.

That’s where MGC becomes your best ally. Micro Gold futures offer a scalable way to hedge. If price begins moving down or breaks below the support zone, one could short MGC against the Short GC 3250 PUT to cap further losses or rebalance directional exposure with reduced size and margin impact.

The Technical Confluence: Where Structure Meets Strategy

The 3250 strike isn’t just a random number—it’s calculated. Historical RSI-based corrections in Gold have shown recent worse-case scenarios around 9.29%, and projecting that from recent highs lands us precisely near the 3255 zone. This level also aligns with a clear UFO support, where institutional buyers have likely left behind unfilled orders.

That confluence—statistical retracement, technical indicator, and order flow support—gives the 3250 strike an interesting probability structure. Selling a Put beneath it means we are placing our bet below the “floor” and getting paid while we wait.

If Gold never corrects that far, we profit.

If it does, we might get long near a historically meaningful level.

There’s no need to catch the top. There’s no need to nail the bottom.

Just structure the trade where the odds are already potentially skewed in your favor.

Trade Plan: Reward, Risk & Realism

This trade isn’t about precision entry or leveraged glory—it’s about risk-defined logic with a cash-flow twist. Here's the full breakdown:

🧠 Trade Parameters

- Strategy: Sell 1x Gold Futures 3250 PUT Options

- Premium Collected: 10.09 points = $1,009

- Point Value (GC): $100/point

- Breakeven Price: 3240 (3250 – 10)

- Expiration: Nov 24, 2025

🟩 If Gold Stays Above 3250

- You keep the full premium → $1,009 profit

🟥 If Gold Falls Below 3250

- You may be assigned 1 GC contra<ct long at 3250

- Unrealized losses begin below breakeven (3240)

- Losses can be significant if Gold falls aggressively

⚠️ Reward-to-Risk?

- Reward is capped at $1,009

- Risk is unlimited below breakeven

- The trade only makes sense if you're prepared to own Gold, or hedge dynamically via MGC or using any other technique

This isn’t a “set-and-forget” income play—it’s a calculated entry into a structured exposure with a fallback plan.

Risk Management: No Margin for Error

Selling naked options isn’t “free money.” It’s responsibility wrapped in premium. Here's what must be considered:

❗ Undefined Risk

When you sell a naked PUT, you're exposed to the full downside. If Gold drops $100 below your strike, that’s a $10,000 loss. Don’t sell naked options unless you’re ready—and capitalized—to buy the underlying or actively hedge it.

🔄 Use MGC to Hedge

If Gold breaks below 3250, using Micro Gold Futures (MGC) offers a surgical way to hedge risk without overleveraging. A simple short MGC can offset GC losses proportionally, depending on how aggressive the move becomes.

🧮 Precision Matters

- Avoid entering trades too early or too large.

- Place an “invalidation” point: if price violates the support zone with conviction, reduce or hedge exposure.

- Never sell premium just because it’s “high”—sell where structure backs the trade.

📊 Discipline Trumps Direction

This strategy is valid only if risk is respected. The market doesn’t owe anyone consistency—but a structured, risk-controlled approach keeps you in the game long enough to see it.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

🌟 Take This Analysis Further with Our AI Scripts 🎯 | Discover How at tradewithufos.com 🚀 Choose a Subscription: Monthly ᴼᴿ Yearly ᴼᴿ Lifetime 🗓️ | Unlock Intelligent UFO Scripts Free 💡

Publications connexes

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

🌟 Take This Analysis Further with Our AI Scripts 🎯 | Discover How at tradewithufos.com 🚀 Choose a Subscription: Monthly ᴼᴿ Yearly ᴼᴿ Lifetime 🗓️ | Unlock Intelligent UFO Scripts Free 💡

Publications connexes

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.