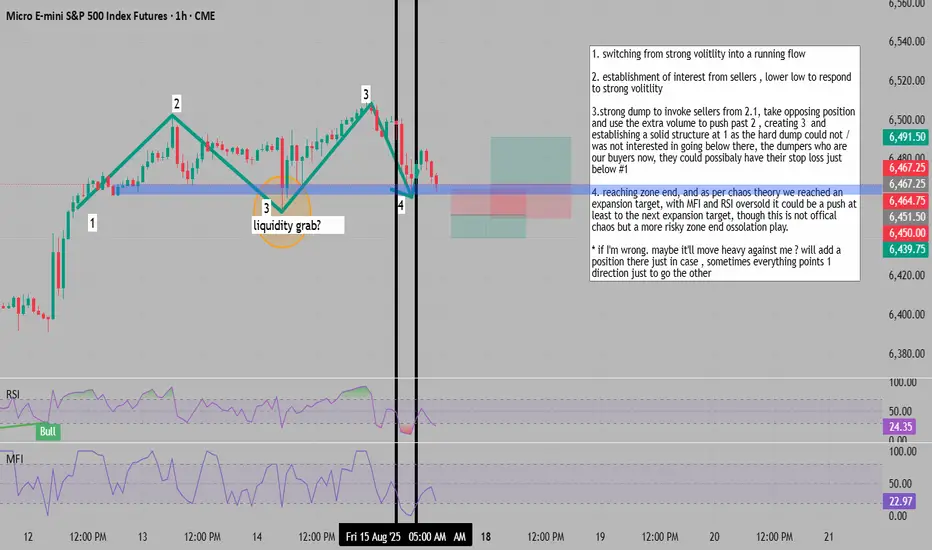

1. **Pattern Recognition**: Identifying a transition from strong volatility into a running flow pattern.

2. **Seller Interest Established**: Lower low formation in response to the initial volatility spike, confirming seller presence at this level.

3. **Liquidity Grab and Reversal**: Strong dump designed to trigger sellers identified in point 2. Take the opposing (long) position here, using the increased volume from triggered sellers to push price past level 2, creating level 3. This establishes solid structure at level 1, as the dump showed no interest in breaking below it. The dumpers (now turned buyers) likely have stop losses positioned just below level 1.

4. **Zone End Target**: Approaching zone end with expansion target reached per chaos theory principles. With both MFI and RSI showing oversold conditions, expecting at minimum a push to the next expansion target. Note: This is an unofficial chaos theory application - a higher risk zone end oscillation play.

**Risk Management Note**: If the analysis is wrong, price may move heavily against the position. Consider adding a hedge position as insurance, as markets sometimes present all signals pointing in one direction only to reverse completely.

2. **Seller Interest Established**: Lower low formation in response to the initial volatility spike, confirming seller presence at this level.

3. **Liquidity Grab and Reversal**: Strong dump designed to trigger sellers identified in point 2. Take the opposing (long) position here, using the increased volume from triggered sellers to push price past level 2, creating level 3. This establishes solid structure at level 1, as the dump showed no interest in breaking below it. The dumpers (now turned buyers) likely have stop losses positioned just below level 1.

4. **Zone End Target**: Approaching zone end with expansion target reached per chaos theory principles. With both MFI and RSI showing oversold conditions, expecting at minimum a push to the next expansion target. Note: This is an unofficial chaos theory application - a higher risk zone end oscillation play.

**Risk Management Note**: If the analysis is wrong, price may move heavily against the position. Consider adding a hedge position as insurance, as markets sometimes present all signals pointing in one direction only to reverse completely.

for trading mentorship and community, message me on telegram : jacesabr_real

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

for trading mentorship and community, message me on telegram : jacesabr_real

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.