Macro Alert: The Stealth Flight 2 Alts (Tariffs, Gold & Privacy)

🚨 MACRO ALERT: The Silent Surge — Altcoins Accumulating Undetected Since April

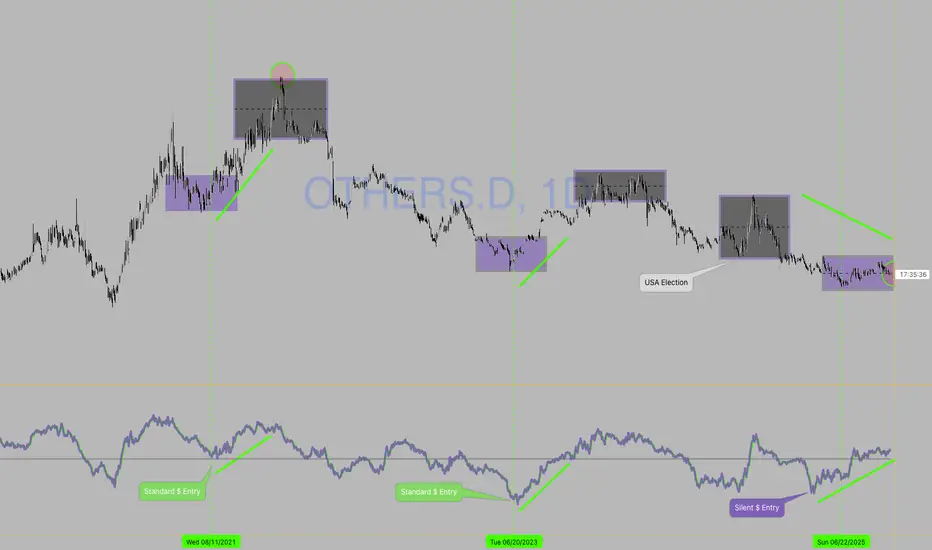

Chart: CRYPTOCAP:OTHERS.D

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 The Setup

While the mainstream remains fixated on Bitcoin's swings, a quiet but significant capital rotation into altcoins is underway. This move, largely undetected by the broader market, is being fueled by shifting global macroeconomic tides and a growing institutional hunt for wealth preservation and financial privacy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 THE CRISIS: Multiple System Failures Converging

🏦 BIS Warning: Global Liquidity Crisis

↓

🇯🇵 Japan: Unsustainable debt from fiscal stimulus

🇫🇷 France: 0.6% growth in 2025, economic stagnation

↓

💸 Coordinated failure of fiat monetary policy

⛓️ Government Attacks on Safe Havens

↓

🇺🇸 U.S. Gold Tariffs: 39% on major imports

Physical metals face capital controls & taxation attacks

Traditional assets no longer safe from state control

🔒 Even Crypto Has Centralization Issues

↓

📜 GENIUS Act: Stablecoins expand M2 money supply (monetizing debt via blockchain)

🏢 XRP: Concentrated token control raises manipulation concerns

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🟢 THE SOLUTION: Where Capital Is Flowing

Smart money is seeking assets with:

• TRUE decentralization

• Privacy features

• Fixed supply

• Institutional-grade infrastructure

The Data Confirms It:

🔐 Privacy Coins (XMR, ZEC): +71.6% in 2025

📊 CRYPTOCAP:BTC: +27.1%

📊 CRYPTOCAP:ETH: +33.4%

📈 OTHERS.D: Rising quietly

This is sophisticated money moving in, not retail FOMO.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💥 The Macro Catalyst: Why This Is Happening Now

⚡ Gold Under Attack: The recent 39% U.S. tariff on major gold imports has rattled the traditional safe-haven market, creating artificial scarcity and signaling a broader trend of government control over monetary assets. When even physical metals face intervention, capital seeks alternatives outside increasingly controlled systems.

🚨 The BIS Warning Nobody Is Discussing:

The Bank for International Settlements is quietly sounding alarms on global liquidity risks:

• 🇯🇵 Japan's fiscal stimulus → unsustainable debt levels

• 🇫🇷 France → 0.6% growth (stagnation)

• 💸 Result: Coordinated fiat monetary policy failure

🪤 The Stablecoin Trap:

The U.S. GENIUS Act is expanding M2 money supply through the back door via stablecoins:

→ Legitimizing stablecoin issuance backed by Treasury bonds

→ Monetizing debt while calling it "innovation"

→ This isn't decentralization—it's the Fed with a blockchain wrapper

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Macro Pressure → Altcoin Opportunities

😰 Worried About: Wealth Confiscation/Control

💡 Consider: Financial Sovereignty & Privacy

🔍 Examples: CRYPTOCAP:XMR , CRYPTOCAP:ZEC

📈 Catalyst: Zcash surged 150%+ on institutional demand (Grayscale Trust)

😰 Worried About: Currency Devaluation & Inflation

💡 Consider: Scarce, Decentralized Stores of Value

🔍 Examples: Altcoins with fixed supplies + robust decentralized governance

🔑 Key: Assets that can't be inflated or controlled by single entities

😰 Worried About: Traditional Finance Instability

💡 Consider: Institutional-Grade Blockchain Infrastructure

🔍 Examples: HBAR (corporate governance) & XRP (cross-border payments)

⚠️ Note: Focus on real-world utility beyond speculation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

What to Watch For

✅ Confirmation: Strong, high-volume breakout above recent range high on CRYPTOCAP:OTHERS.D

🔍 The Privacy Pulse: Continued strength in privacy coins ( CRYPTOCAP:XMR , CRYPTOCAP:ZEC , XVG.D) is a key leading indicator. Note: Privacy coins face regulatory challenges and have been delisted from some major exchanges.

❌ Invalidation: Break and close below key support zone (April low structure) would suggest macro fears haven't overcome broader market uncertainty.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 The Bottom Line

The gold tariff is a symptom of a larger disease: eroding trust in neutral, non-government monetary assets. This is forcing a "regime change" in capital allocation.

As this realization dawns on more investors, the quiet accumulation in altcoins—particularly those offering privacy, sovereignty, and real-world utility—could explode into the next major market narrative.

💭 Smart money is moving early. The question is: will you recognize this shift before it becomes obvious?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Disclaimer: This is macroeconomic observational analysis and is not financial advice. Always conduct your own research (DYOR) and manage risk appropriately.

Cheers!

Chart: CRYPTOCAP:OTHERS.D

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 The Setup

While the mainstream remains fixated on Bitcoin's swings, a quiet but significant capital rotation into altcoins is underway. This move, largely undetected by the broader market, is being fueled by shifting global macroeconomic tides and a growing institutional hunt for wealth preservation and financial privacy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 THE CRISIS: Multiple System Failures Converging

🏦 BIS Warning: Global Liquidity Crisis

↓

🇯🇵 Japan: Unsustainable debt from fiscal stimulus

🇫🇷 France: 0.6% growth in 2025, economic stagnation

↓

💸 Coordinated failure of fiat monetary policy

⛓️ Government Attacks on Safe Havens

↓

🇺🇸 U.S. Gold Tariffs: 39% on major imports

Physical metals face capital controls & taxation attacks

Traditional assets no longer safe from state control

🔒 Even Crypto Has Centralization Issues

↓

📜 GENIUS Act: Stablecoins expand M2 money supply (monetizing debt via blockchain)

🏢 XRP: Concentrated token control raises manipulation concerns

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🟢 THE SOLUTION: Where Capital Is Flowing

Smart money is seeking assets with:

• TRUE decentralization

• Privacy features

• Fixed supply

• Institutional-grade infrastructure

The Data Confirms It:

🔐 Privacy Coins (XMR, ZEC): +71.6% in 2025

📊 CRYPTOCAP:BTC: +27.1%

📊 CRYPTOCAP:ETH: +33.4%

📈 OTHERS.D: Rising quietly

This is sophisticated money moving in, not retail FOMO.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💥 The Macro Catalyst: Why This Is Happening Now

⚡ Gold Under Attack: The recent 39% U.S. tariff on major gold imports has rattled the traditional safe-haven market, creating artificial scarcity and signaling a broader trend of government control over monetary assets. When even physical metals face intervention, capital seeks alternatives outside increasingly controlled systems.

🚨 The BIS Warning Nobody Is Discussing:

The Bank for International Settlements is quietly sounding alarms on global liquidity risks:

• 🇯🇵 Japan's fiscal stimulus → unsustainable debt levels

• 🇫🇷 France → 0.6% growth (stagnation)

• 💸 Result: Coordinated fiat monetary policy failure

🪤 The Stablecoin Trap:

The U.S. GENIUS Act is expanding M2 money supply through the back door via stablecoins:

→ Legitimizing stablecoin issuance backed by Treasury bonds

→ Monetizing debt while calling it "innovation"

→ This isn't decentralization—it's the Fed with a blockchain wrapper

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Macro Pressure → Altcoin Opportunities

😰 Worried About: Wealth Confiscation/Control

💡 Consider: Financial Sovereignty & Privacy

🔍 Examples: CRYPTOCAP:XMR , CRYPTOCAP:ZEC

📈 Catalyst: Zcash surged 150%+ on institutional demand (Grayscale Trust)

😰 Worried About: Currency Devaluation & Inflation

💡 Consider: Scarce, Decentralized Stores of Value

🔍 Examples: Altcoins with fixed supplies + robust decentralized governance

🔑 Key: Assets that can't be inflated or controlled by single entities

😰 Worried About: Traditional Finance Instability

💡 Consider: Institutional-Grade Blockchain Infrastructure

🔍 Examples: HBAR (corporate governance) & XRP (cross-border payments)

⚠️ Note: Focus on real-world utility beyond speculation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

What to Watch For

✅ Confirmation: Strong, high-volume breakout above recent range high on CRYPTOCAP:OTHERS.D

🔍 The Privacy Pulse: Continued strength in privacy coins ( CRYPTOCAP:XMR , CRYPTOCAP:ZEC , XVG.D) is a key leading indicator. Note: Privacy coins face regulatory challenges and have been delisted from some major exchanges.

❌ Invalidation: Break and close below key support zone (April low structure) would suggest macro fears haven't overcome broader market uncertainty.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 The Bottom Line

The gold tariff is a symptom of a larger disease: eroding trust in neutral, non-government monetary assets. This is forcing a "regime change" in capital allocation.

As this realization dawns on more investors, the quiet accumulation in altcoins—particularly those offering privacy, sovereignty, and real-world utility—could explode into the next major market narrative.

💭 Smart money is moving early. The question is: will you recognize this shift before it becomes obvious?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Disclaimer: This is macroeconomic observational analysis and is not financial advice. Always conduct your own research (DYOR) and manage risk appropriately.

Cheers!

Cheers!

Aiggy

Aiggy

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Cheers!

Aiggy

Aiggy

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.