The secret to trading isn’t winning every trade - it’s about managing risk.

Risk management and trading. This is one of the most important topics if you’re

serious about becoming a profitable trader. Risk management is the foundation of trading. If

you don’t manage your risk you won’t make it. Simple as that.

No one can predict whether the market will go up or down with 100%

certainty. That’s why as traders we can never fully control how much profit we make. But we

can control one thing. How much we lose. And that brings us to the first step in risk

management. Understanding the power of the risk-reward ratio.

When choosing a trading strategy that suits you one of the factors to consider is its risk-reward

ratio. Every strategy has its own balance between risk and potential reward and understanding

this is key. This is where we need to put our math brains to work.

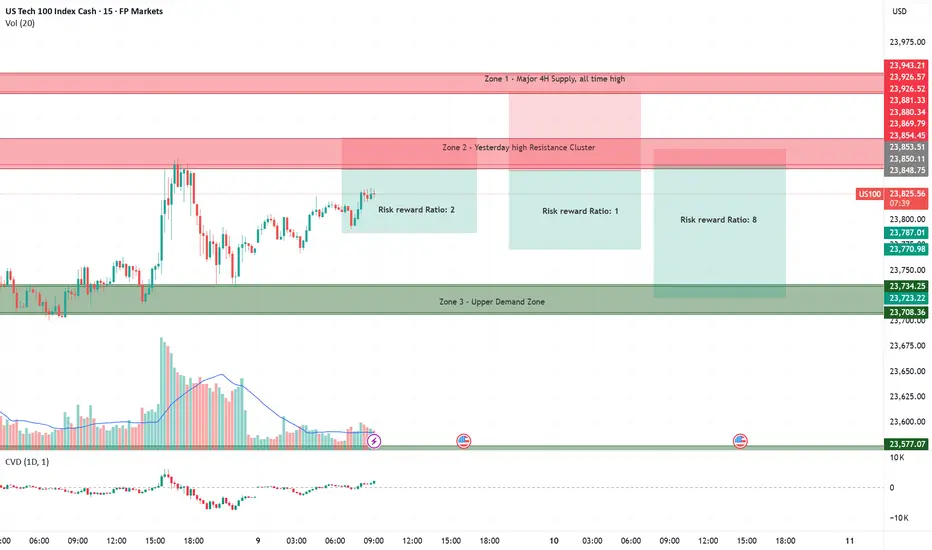

What is the risk-reward ratio? Simply put it tells us how much we stand to gain for every unit

of risk we take. It’s a straightforward but powerful metric that helps determine whether a

strategy can be profitable over time.

Let’s break it down with a simple example:

• If your strategy has a 1:1 risk-reward ratio it means that for every $100 you risk you

aim to make $100 in profit. Win or lose the potential gain and loss are the same.

• If your strategy has a 1:2 risk-reward ratio you risk losing $100, but if the trade goes

your way you make $200. This means your potential reward is twice as big as your risk.

• If your strategy has a 1:5 risk-reward ratio for every $100 you risk you have the

chance to make $500. Here the possible reward is much greater than the risk you take.

Your risk-reward ratio has a big impact on your overall profitability. But the risk-reward ratio

alone doesn’t tell the full story. To know if a strategy is truly profitable you also need to

consider another key factor: Win rate.

Your win rate is the percentage of trades that end in profit. This is where math and probabilities come into play.

• If your strategy has a 50% win rate it means that out of 10 trades 5 are winners and 5

are losers.

• If your win rate is 40% 4 out of 10 trades will be profitable.

The key to long-term success is finding the right balance between risk-reward and win rate.

• If you have a 1:1 risk-reward ratio and a 40% win rate your strategy won’t be

profitable. Over 10 trades you win 4 times and lose 6 times. Since you win and lose the

same amount per trade your losses will be bigger than your gains in the long run.

• But with a 1:5 risk-reward ratio and the same 40% win rate your strategy becomes

profitable. That’s because your winning trades make far more than you lose on your

losing trades.

The takeaway? There’s no such thing as a right or wrong strategy only ones that are profitable

or unprofitable. The key is to find a strategy that gives you a mathematical edge over time.

Risk management and trading. This is one of the most important topics if you’re

serious about becoming a profitable trader. Risk management is the foundation of trading. If

you don’t manage your risk you won’t make it. Simple as that.

No one can predict whether the market will go up or down with 100%

certainty. That’s why as traders we can never fully control how much profit we make. But we

can control one thing. How much we lose. And that brings us to the first step in risk

management. Understanding the power of the risk-reward ratio.

When choosing a trading strategy that suits you one of the factors to consider is its risk-reward

ratio. Every strategy has its own balance between risk and potential reward and understanding

this is key. This is where we need to put our math brains to work.

What is the risk-reward ratio? Simply put it tells us how much we stand to gain for every unit

of risk we take. It’s a straightforward but powerful metric that helps determine whether a

strategy can be profitable over time.

Let’s break it down with a simple example:

• If your strategy has a 1:1 risk-reward ratio it means that for every $100 you risk you

aim to make $100 in profit. Win or lose the potential gain and loss are the same.

• If your strategy has a 1:2 risk-reward ratio you risk losing $100, but if the trade goes

your way you make $200. This means your potential reward is twice as big as your risk.

• If your strategy has a 1:5 risk-reward ratio for every $100 you risk you have the

chance to make $500. Here the possible reward is much greater than the risk you take.

Your risk-reward ratio has a big impact on your overall profitability. But the risk-reward ratio

alone doesn’t tell the full story. To know if a strategy is truly profitable you also need to

consider another key factor: Win rate.

Your win rate is the percentage of trades that end in profit. This is where math and probabilities come into play.

• If your strategy has a 50% win rate it means that out of 10 trades 5 are winners and 5

are losers.

• If your win rate is 40% 4 out of 10 trades will be profitable.

The key to long-term success is finding the right balance between risk-reward and win rate.

• If you have a 1:1 risk-reward ratio and a 40% win rate your strategy won’t be

profitable. Over 10 trades you win 4 times and lose 6 times. Since you win and lose the

same amount per trade your losses will be bigger than your gains in the long run.

• But with a 1:5 risk-reward ratio and the same 40% win rate your strategy becomes

profitable. That’s because your winning trades make far more than you lose on your

losing trades.

The takeaway? There’s no such thing as a right or wrong strategy only ones that are profitable

or unprofitable. The key is to find a strategy that gives you a mathematical edge over time.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.