OPEN-SOURCE SCRIPT

Mis à jour Index Reversal Range with Volatility Index or VIX

What is the Indicator?

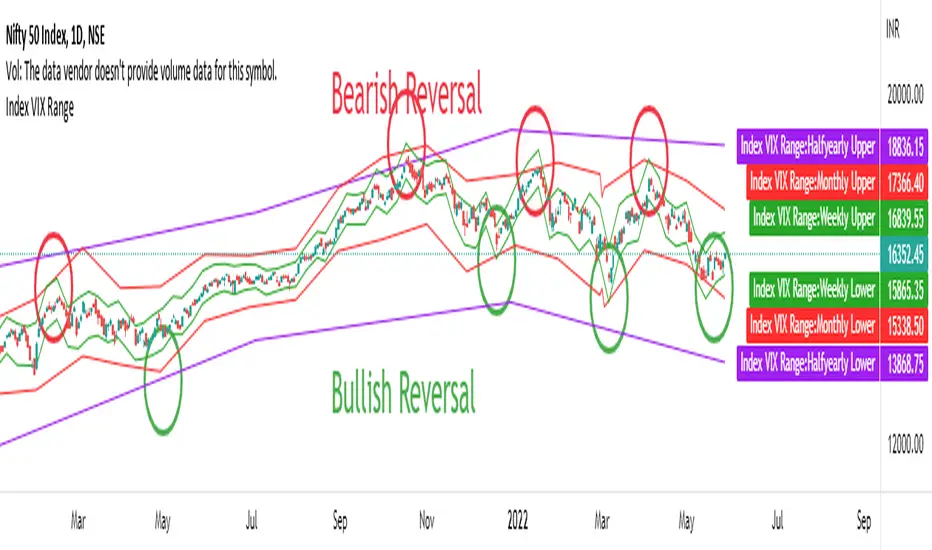

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

Notes de version

Updated on 29 May 2022- Added dots between lines.

Notes de version

Updated on 31 May 2022- Updated with current Volatility levels as Lines and Labels.

- The number in % is the Volatility Percentage which appear at the end of each label.

- Removed the dots on lines as it looks clustered.

Notes de version

Updated on 10 June 2022- Added timeframes 30, 5 and 1 minutes.

Note: The gap between lines is the limitation of script. Draw a line manually to fill that for now.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.