Volume Profile Auto POC📌 Overview

Volume Profile Auto POC is a trend-following strategy that uses the automatically calculated Point of Control (POC) from the volume profile, combined with ATR zones, to capture reversals and breakouts.

By basing decisions on volume concentration, it dynamically visualizes the price levels most watched by market participants.

⚠️ This strategy is provided for educational and research purposes only.

Past performance does not guarantee future results.

🎯 Strategy Objectives

Automatically detect the volume concentration area (POC) to improve entry accuracy

Optimize risk management through ATR-based volatility adjustment

Provide early and consistent signals when trends emerge

✨ Key Features

Automatic POC Detection : Updates the volume profile over a defined lookback window in real time

ATR Zone Integration : Defines a POC ± 0.5 ATR zone to clarify potential reversals/breakouts

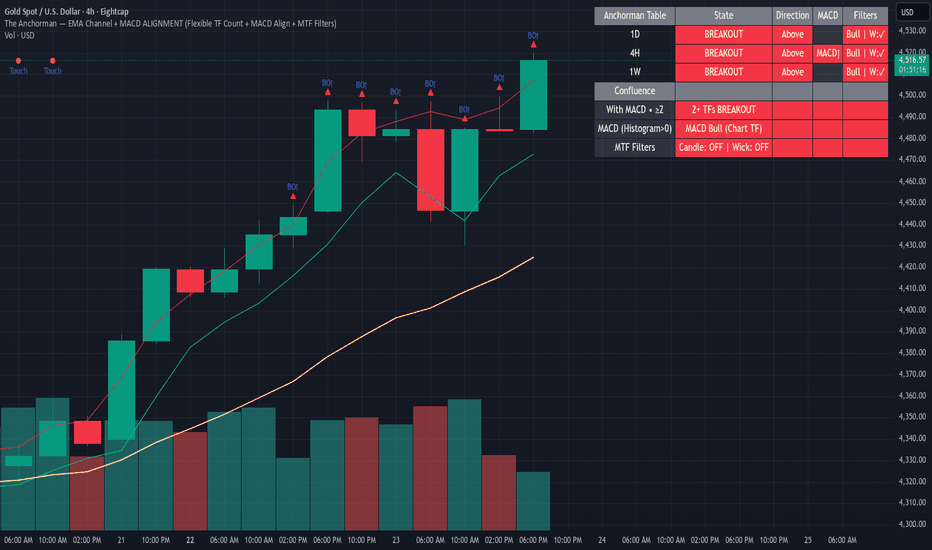

Visual Support : Plots the POC line and zones on the chart for intuitive decision-making

📊 Trading Rules

Long Entry:

Price breaks above the POC + 0.5 ATR zone

Volume is above average to support the breakout

Short Entry:

Price breaks below the POC - 0.5 ATR zone

Volume is above average to support the downside move

Exit (or Reverse Position):

Price returns to the POC area

Or touches the ATR band

⚙️ Trading Parameters & Considerations

Indicator Name: Volume Profile Auto POC

Parameters:

Lookback Bars: 50

Bins for Volume Profile: 24

ATR Length: 14

ATR Multiplier: 2.0

🖼 Visual Support

POC line plotted in red

POC ± 0.5 ATR zone displayed as a semi-transparent box

ATR bands plotted in blue for confirmation

🔧 Strategy Improvements & Uniqueness

This strategy is inspired by traditional Volume Profile + ATR analysis,

while adding the improvement of a sliding-window mechanism for automatic POC updates.

Compared with conventional trend-following approaches,

its strength lies in combining both price and volume perspectives for decision-making.

✅ Summary

Volume Profile Auto POC automatically extracts key market levels (POC) and combines them with ATR-based zones,

providing a responsive trend-following method.

It balances clarity with practicality, aiming for both usability and reproducibility.

⚠️ This strategy is based on historical data and does not guarantee future profits.

Always use proper risk management when applying it.

Indicateur Pine Script®